A Gift Affidavit is a legal document that formally declares a gift's transfer from one person to another without any expectation of compensation. Utilizing Gift Affidavit templates ensures that all necessary legal elements are included, simplifies the drafting process, and provides a consistent and professional format, thereby reducing the risk of errors and ensuring the document's validity.

6 min read Dr. Moina Rauf Written ByDr. Moina Rauf, fluent in English and Dutch, is a distinguished writer and editor with a PhD in Economics and a Bachelor’s degree in English Literature and Economics. With extensive experience in both academia and industry, she excels in elucidating complex concepts about business management, human resources policies, legal documentation, employee leaves, appointments, contracts, and workplace culture. Her proficiency in analyzing and simplifying intricate documents ensures comprehensive understanding for her audience. Published in academic journals, Dr. Rauf’s authority in her field is well-established.

Giving gifts is a timeless custom that people from all cultures follow. It is a show of generosity, love, and gratitude. It can bring happiness and strengthen relationships, whether the gift is a priceless family heirloom, a brand-new car, or a sizeable quantity of money. Although gifts often bring joy and appreciation, they can also have significant legal and financial ramifications if the appropriate paperwork is not done. This is the point at which a gift affidavit is very useful. A gift affidavit is a legal document that formalizes the gift transaction, ensures clarity, and protects the interests of both the giver and the recipient.

In this blog post, we will discuss the concept of gift affidavits, explain why they are essential, and guide you on how to create one seamlessly. In addition, to assist you in getting started, we provide free, user-friendly templates. To address any uncertainties, we’ve included a comprehensive FAQ section covering common questions and clarifying many elements related to gift affidavits.

Whether you’re planning to give a significant gift or you’re on the receiving end, understanding the importance of a gift affidavit can save you from potential complications and ensure that your generous gesture remains a positive experience for everyone involved. So, let’s get started and ensure that your gift-giving is both heartfelt and hassle-free!

A gift affidavit can be crucial for various reasons, including legal, financial, and protective purposes. Here’s an elaboration on why you might need a gift affidavit:

Legal Protection: A gift affidavit provides a clear, legal record of the transaction, which can be useful in disputes or legal issues.

Tax Use: A gift affidavit can be used as supporting documentation for tax filings in the case of larger gifts, particularly those that surpass the annual gift tax exclusion limit.

Clarification: In families where dynamics can be complex, a gift affidavit can play a vital role in clarifying the giver’s intentions. It can help prevent misunderstandings or conflicts among heirs by providing a clear and legal declaration of the gift.

Good to know

Any gift affidavit made in the United States that is used outside of the country requires notarization and apostille.

These gift affidavit templates ensure thorough and legally sound documentation for any gift transaction. They are created following extensive research, comply with legal requirements, and record crucial data like donor and recipient information, property details, the kind and value of the gift, and any related debts. Available in DOTX, DOCX, Google Docs, and ODT formats, these templates offer flexibility and ease of use for comprehensive documentation of gift transactions.

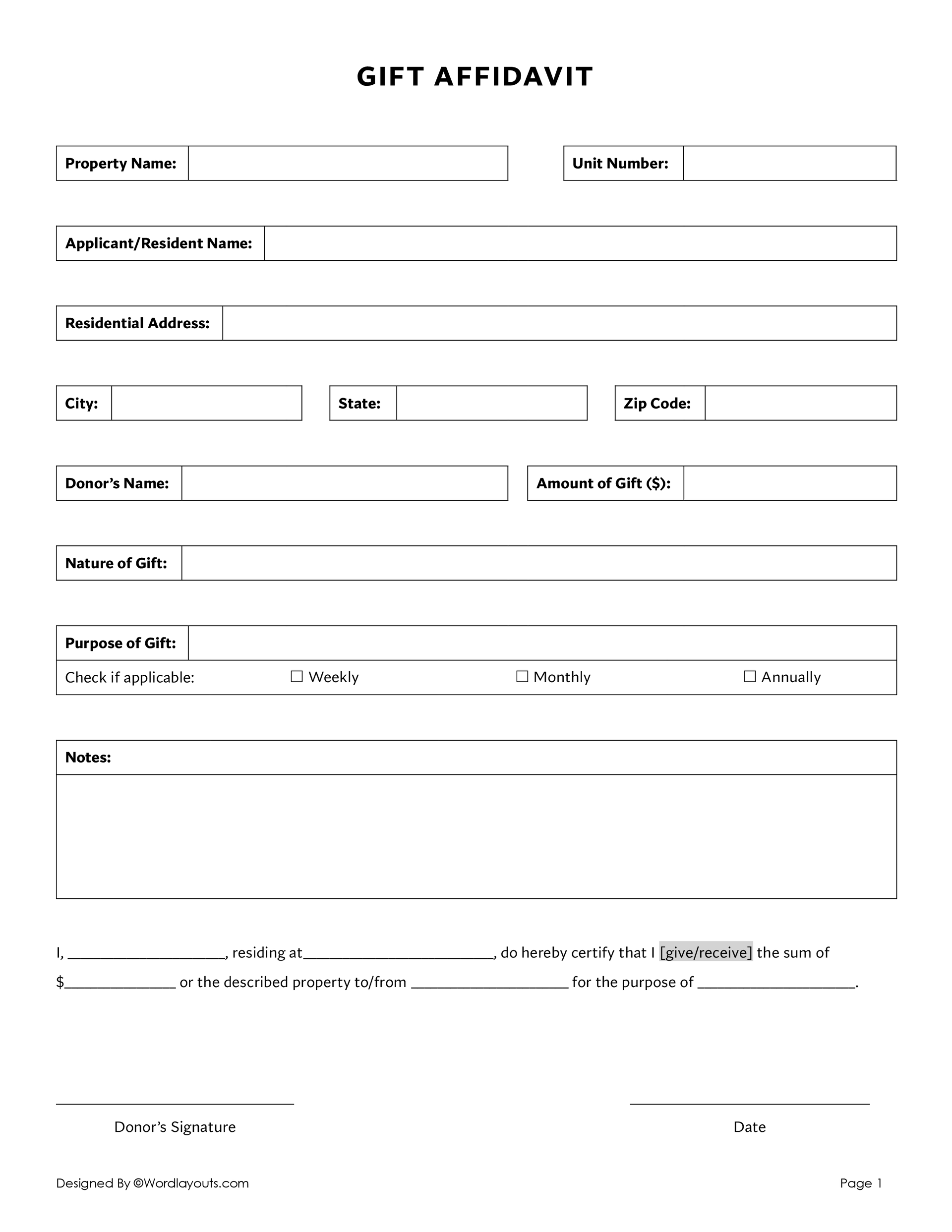

Designed for straightforward gift transactions, this user-friendly template captures essential information, is suitable for individuals, small business owners, and financial advisors, and includes a notary acknowledgment for added legal security.

The form begins with fields for property identification, including the property name and unit number. It collects applicant or resident information, such as their name and residential address, along with city, state, and zip code details. This ensures the precise location of the involved parties is clearly documented.

In the donor’s information section, the template specifies fields for the donor’s name and the amount of the gift, which ensures the financial aspects of the gift are transparent. The nature of the gift is described, which provides a detailed characterization of what is being transferred.

Additionally, the purpose of the gift section includes checkboxes to indicate whether the gift is given on a weekly, monthly, or annual basis, which is crucial for understanding the frequency of the gift transfer. A notes section is included to capture any additional relevant information or specific conditions for the gift.

The certification statement at the bottom of the form allows the donor to affirm the gift transfer and specify whether they give or receive the gift, the sum involved, and the purpose of the transaction. The donor’s signature and date fields authenticate the document and ensure its legal validity.

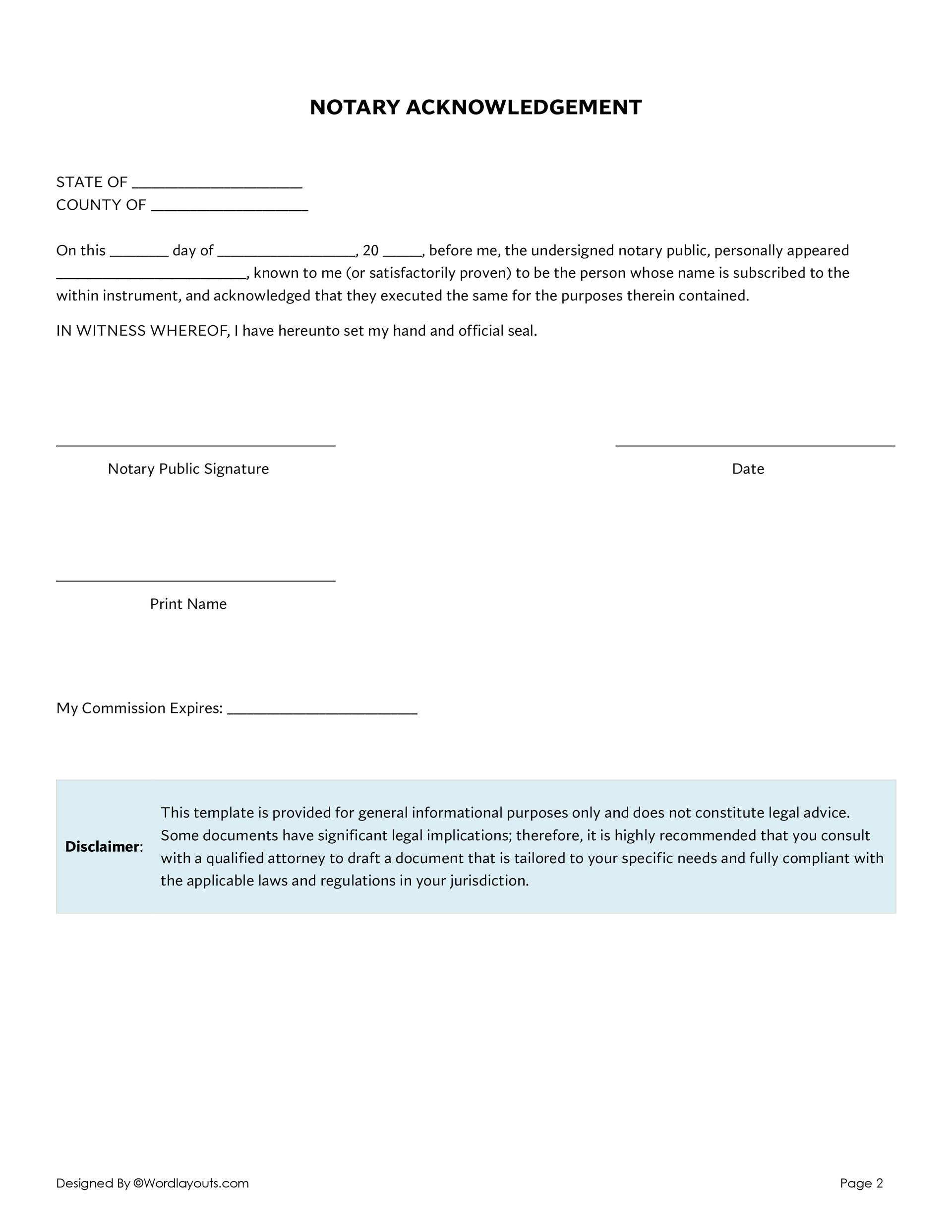

The notary acknowledgment section, which also includes the notary public’s signature, date, print name, commission expiration date, and state and county details, validates the affidavit’s execution.

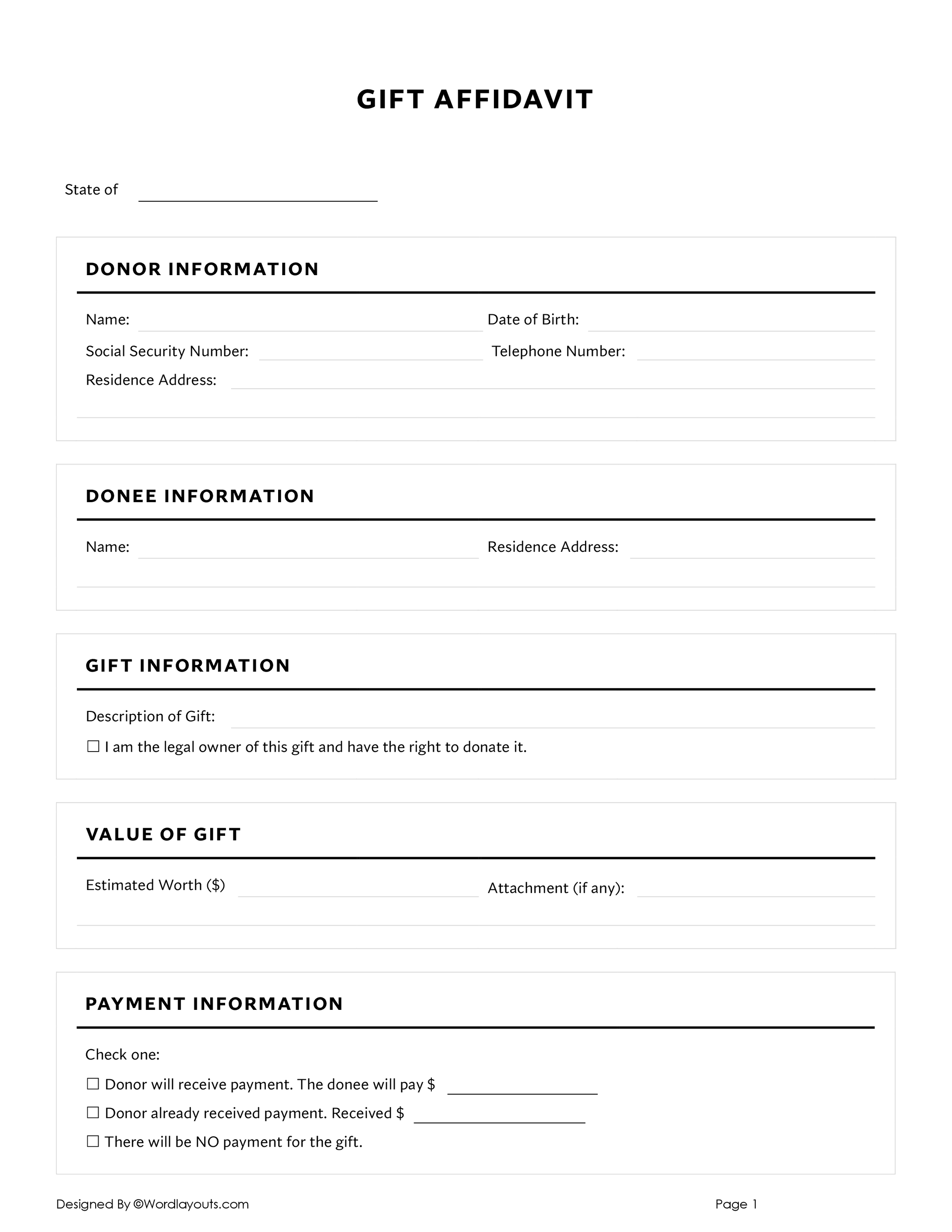

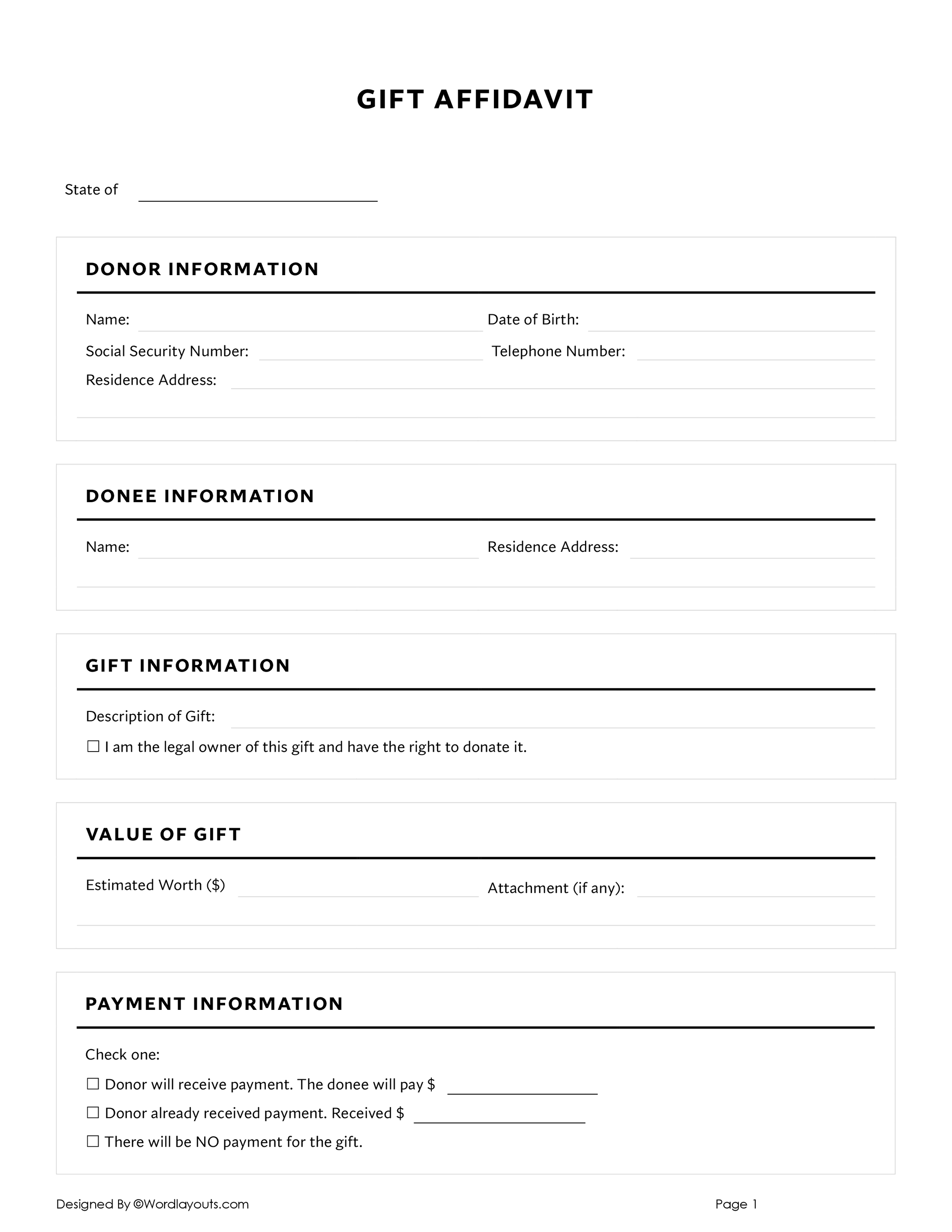

This template is ideal for complex and high-value gift transactions and is perfect for real estate agents, property managers, and legal professionals. It starts with fields for state identification and then has extensive sections for donee and donor data. The donor’s details include their name, date of birth, social security number, telephone number, and residence address, while the donee’s section captures their name and residence address.

The gift information section requires a description of the gift and a checkbox to affirm the donor’s legal ownership and right to donate it. The value of the gift is also detailed, with fields for its estimated worth and any attachments. Payment information is specified through checkboxes indicating whether the donor will receive payment, if the donor has already received payment, or if no payment is involved.

Debt information is another critical section, where options are provided to state if any debt associated with the gift is being transferred to the donee, if the gift is free of liens or debts, or if there are no debts associated with the gift. Signature fields for both the donor and donee and dates are included to validate the document.

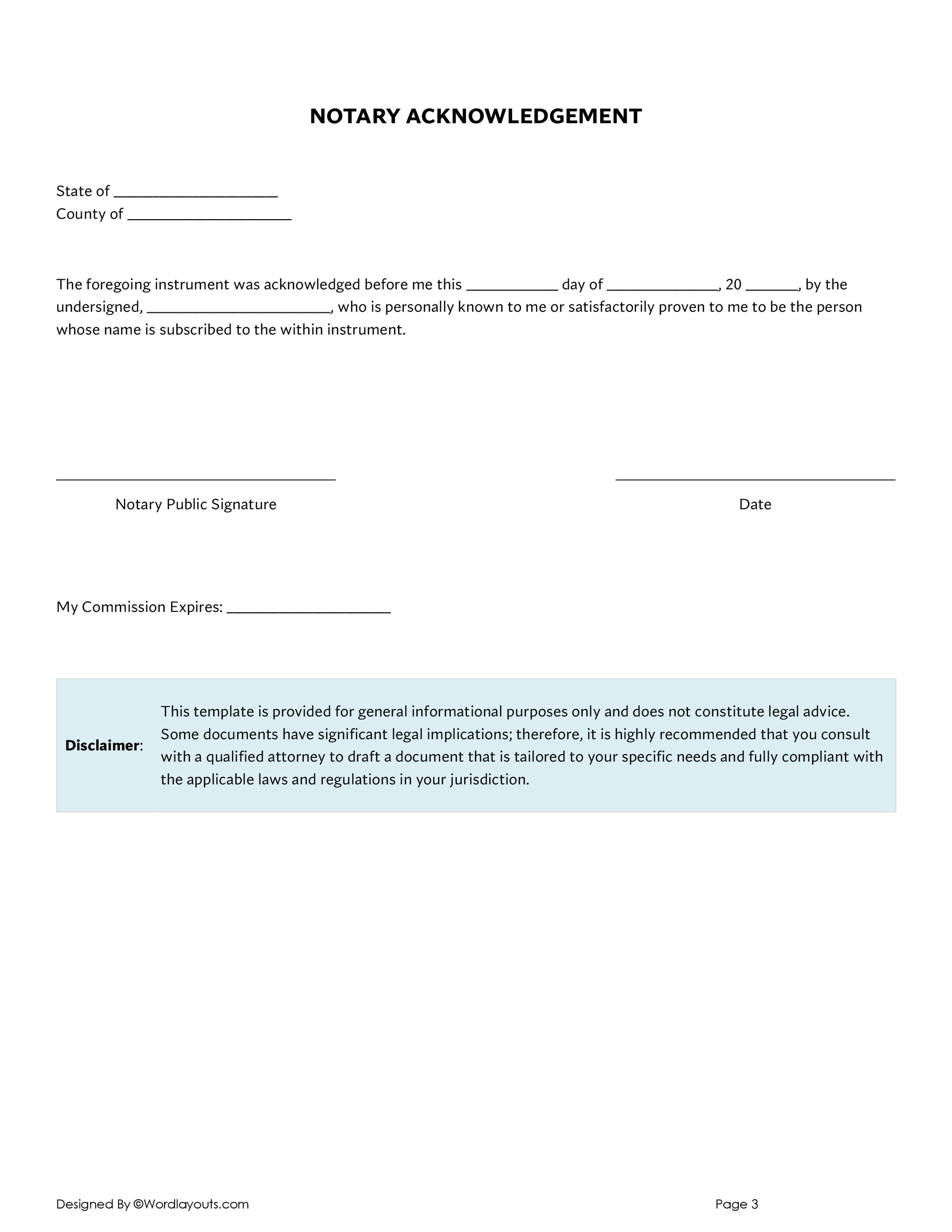

Additionally, the template includes a notary acknowledgment section, requiring state and county information and a formal statement for the notary public to confirm the acknowledgment. The notary public must sign and date this section, along with noting their commission expiration date. A disclaimer is also provided, emphasizing that the template is for informational purposes and recommending consulting a qualified attorney to ensure compliance with applicable laws and regulations. This thorough structure ensures that all technical and legal aspects of the gift transfer are properly documented and validated.

For federal gift tax purposes, Form 709 is used to report large gifts and generation-skipping transfers. You might need to file this form if you:

Always consult the IRS for the latest updates on gift tax limits and regulations, as these can change annually. This ensures compliance and optimal tax planning when making and reporting gifts.

A gift is a transfer of property or assets made during the giver’s lifetime, whereas a bequest is a transfer that occurs upon the giver’s death, as outlined in their will. A gift is immediate and irrevocable once given, while a bequest can be changed or revoked any time before the giver’s death by updating the will.

The tax implications of receiving a gift vary by jurisdiction. In some countries, the recipient may need to report the gift for tax purposes if it exceeds a certain value. Additionally, the giver may be responsible for paying gift tax if the gift exceeds the annual or lifetime exclusion limits set by the tax authorities. It’s important to consult with a tax professional to understand the specific tax obligations related to gifts in your area.

Yes, gifting assets during your lifetime can potentially reduce the size of your taxable estate, which may decrease the amount of estate tax owed upon your death. By transferring assets as gifts, you can utilize annual and lifetime gift tax exemptions to lower the overall value of your estate. However, it’s important to plan carefully and consult with an estate planning professional to ensure compliance with tax laws and optimize the tax benefits of gifting.

Yes, many jurisdictions offer annual and lifetime exemptions or exclusions for gift tax. For example, in the United States, there is an annual gift tax exclusion amount that allows individuals to give a certain amount to any number of recipients each year without incurring gift tax. Additionally, there is a lifetime exemption that covers gifts exceeding the annual exclusion limit. These exemptions can vary, so it’s essential to check the current limits and rules in your specific jurisdiction.

A gift affidavit can also be used to document charitable donations, particularly significant or non-cash gifts. It provides a clear record of the donation, which can be essential for claiming tax deductions. The affidavit should include details about the charitable organization, the donated asset, and its value, as well as the donor’s intent for the donation to be a gift.